Data we are tracking remains firm.

- Avory Team

- Apr 3

- 7 min read

Hope everyone had a chance to tune into our recent webcast covering the four new companies we’ve added to the portfolio over the past two weeks. These were funded using fresh capital from removing positions where we had already locked in gains.

Now, onto the data.

This may sound counter to the headlines, but the data continues to support both the economy and our investment thesis. The companies we own are showing healthy fundamentals — and we track this in real time. Zoom appears to have just posted one of its strongest beats relative to guidance in a while. Zillow is also tracking well — and it’s not alone. Consumer spending and jobs data remain firm — see all the data below.

While sentiment is weak, uncertainty alone isn’t a reason to sell for long-term investors. We stay disciplined. If we see risk of permanent capital loss, we’ll act — but we don’t see that risk today.

The companies we own are industry leaders, with strong balance sheets and business models that are largely insulated from direct tariff impacts.

The fundamentals are holding up. Lets get to the data for economy, tariffs, and markets!

Here is the summary if you want just that:

Small businesses are hiring; ad spend is rising

Labor market added 228K jobs; underemployment ticked down

Inflation at 1.4% — room to absorb 1–2% tariff impact

Tariffs likely about negotiation + revenue recycling

Mexico/Canada left out of remarks; China trade share down to 11%

Fiserv Small Business Index rose to 150 in March (+1.8% MoM, +5.5% YoY)

Small businesses are often the first to flinch in downturns. We are NOT seeing it. The Fiserv index shows continued expansion, signaling healthy demand and operational stability across sectors. Resilient bottom-up activity supports broader economic strength

Small business ad spend — tracked through real-time Facebook CPMs — rose 7% month over month, confirming steady demand. It's another signal that small businesses are still leaning in, not pulling back. We will track closely.

What about people searching for unemployment, benefits, or anything related? Not showing up — at least not yet.

Compare it to the massive spike in 2020 — we’re nowhere near that. Another sign the labor market remains stable for now.

This lines up with the jobs report released this morning:

228K jobs added

Underemployment fell to 7.9% from 8.0%

We’re likely running at a steady ~150K/month pace, which suggests the labor market remains healthy — not overheating, not collapsing.

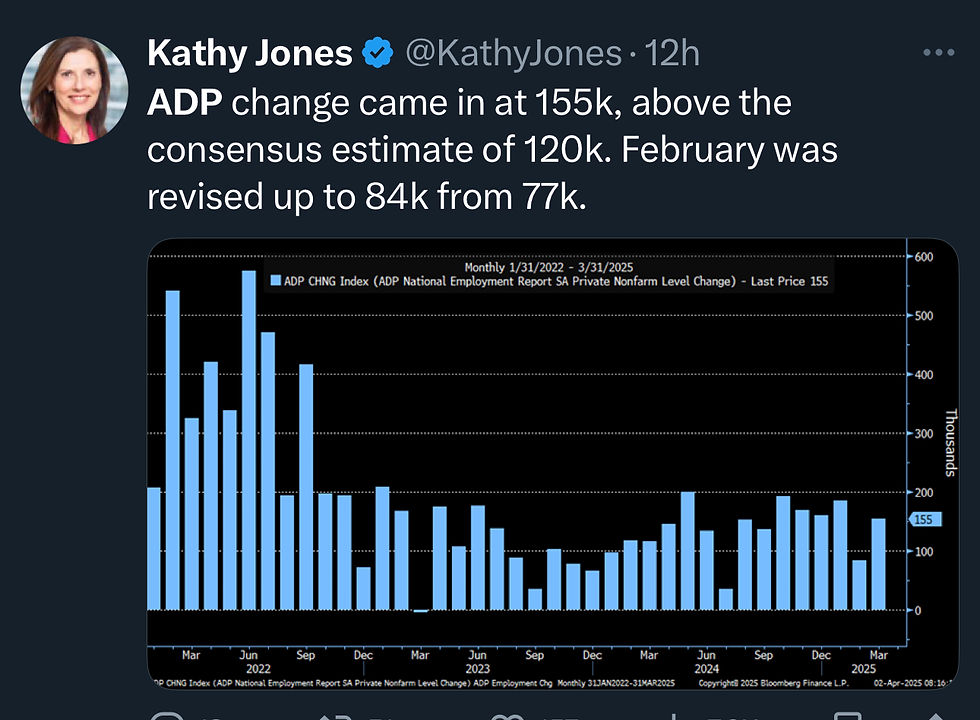

That matched ADP which also came out this week. ADP added 155k jobs.

Small businesses added 52K jobs, matching the strength of large corporations.

This confirms what we highlighted two weeks ago — Bank of America’s small business job adds turned positive for the first time in 3 years. That momentum is now showing up in the broader data.

We also just added 21k manufacturing jobs, most growth in this area since 2022.

There’s been a lot of concern around DOGE and their cuts, and its potential drag on the economy.

But here’s a fact: Treasury spending data is public and trackable in real time — and it’s actually up year-to-date.

Yes, government spending is rising, not falling. That’s a key support many are overlooking.

Going through all the government spending line items we came across small business administration spending year to date. Look at that. It is tracking nearly 2x of last year at this time!

Complement that with tax refund checks going out to consumers up now 6% year over year. This is extra money back into consumer pockets right now!

What about foot traffic. Look at the bounce back from February in things like restaurants.

A couple more things on the economy before we shift to tariffs and market action:

Inflation is currently tracking around 1.4% — a solid starting point if tariffs do come into play.

Some forecasts suggest tariffs could add 1–2% to pricing, which would lift real-time inflation to 2.4–3.4%. That’s still well below crisis territory.

And that’s assuming two big things:

Tariffs stick, and

Consumers don’t adjust by trading down or shifting to non-tariffed alternatives.

So far, the setup looks manageable.

Markets are currently pricing in 3–4 rate cuts this year. While that remains a moving target, it would provide additional support alongside everything mentioned above — especially when combined with potential tax cuts.

Now onto tariffs.

We continue to believe this is primarily about negotiation leverage + revenue generation — not purely protectionism.

What matters most is how the tariff revenue is used. If it’s recycled back into the economy through tax cuts or fiscal support, it doesn’t have to be GDP-negative.

Instead, it becomes a reshuffling of GDP, not a drag on it overtime.

Following the president’s presentation, it’s notable that he left out our top two trading partners — Mexico and Canada. That signals a degree of flexibility in the approach.

Latin America, in general, came out mostly unscathed compared to Asia.

As for China, that remains a longer-term battle. But it’s worth noting their share of U.S. trade has already fallen from 20% to 11% over the years — their influence is shrinking and will likely shrink more.

Here is the formula they used for tariffs. Which is a formula nobody has ever used, and honestly laughable. I regress.

Also, Tom Less makes a solid point about tariff concentration: 70% of tariffs come from just six major partners. So any shifts among them could quickly impact overall tariff levels.

Now you’d expect tariffs to push prices up now, especially in autos — but we’re actually seeing the opposite. Automakers appear focused on gaining market share, using the tariff narrative as a 'buy now' incentive. Instead of raising prices, they’re cutting them and offering more sales. Here was Ford.

This is driving strong current demand for cars. Sales just hit a 17 million run rate — back to pre-COVID levels and the highest since peak 2021 demand.

Yet economic uncertainty is at COVID levels. The data I just showed is NOT matching that view.

And credit spreads — which reflect the risk bond investors see in companies' ability to repay — remain low by historical standards. Yes, they’ve widened recently, but only from record lows.

Now uncertainty is high, but what does that mean for future eaturns. Historically market do well goign forward. Obivously this is coming from a place of uncertainty and market downward movements, but the time to get uncerat is now when we hit peak uncertainty.

Look at the google searches for Nasdaq… Record highs.

If you try to time every bout of uncertainty — which, let’s be honest, happens nearly every year — you’ll end up chasing shadows. Sure, you can hedge when risks seem to be rising. But take 2022 as an example: buying S&P puts that year would’ve cost you more than just staying invested, even though the market was down.

The market is resilient — because businesses are resilient. Companies adapt, even through major shocks. Just look at history: from Brexit to world wars, assassinations to the global financial crisis — markets have weathered it all and found a way forward.

Last night, we heard from three companies: Home Depot, Ulta, and Guess.

Guess noted they’re already shifting production to Latin America to benefit from lower tariffs — a real-time example of supply chain adaptation.

Ulta said they haven’t seen any meaningful changes in consumer behavior at their stores, which reinforces the earlier point about resilience in spending.

Home Depot mentioned that they have been preparing for this reality for sometime.

All together, sentiment is rough — we’re now six straight weeks with investor bearishness above 50%. The only other time we’ve seen a streak like this was back in 1990. That’s rare pessimism.

Takeaway:

Despite heavy uncertainty, the underlying economic picture remains far more resilient than sentiment suggests. Look GDP in Q1 will look weak, but there are lots nuances to it as we mentioned on prior posts.

Small businesses are hiring, ad spend is up, and real-time indicators like the Fiserv Index and Facebook CPMs confirm solid Small businesses are hiring; ad spend is rising

• Labor market added 228K jobs; underemployment ticked down

• Inflation at 1.4% — room to absorb 1–2% tariff impact

• Tariffs likely about negotiation + revenue recycling

• Mexico/Canada left out of remarks; China trade share down to 11%

Labor market remains firm — 228K jobs added in March, underemployment down, and small business hiring as strong as large corporations.

Inflation is tracking at just 1.4%, giving room for absorption of potential tariff impacts (forecasted to lift prices 1–2%) without triggering a crisis-level response.

Tariffs appear to be more about negotiation and revenue recycling, not a structural drag. If funds are redirected into tax cuts or support, this is a reshuffling, not a GDP hit.

President’s remarks suggest strategic targeting, with Mexico and Canada left out and Latin America largely spared — while China remains a longer-term challenge, its trade weight has already declined meaningfully.

Meanwhile, investor sentiment is at rare levels of pessimism, historically a contrarian signal for forward returns.

Bottom line: Fundamentals remain solid enough. Businesses are adapting. Consumers continue spending. We are navigating, keeping our eye on the data. If it changes, so do we!

About Avory & Co.

Investing where the world is headed.

Avory specializes in high-conviction equity strategies, emphasizing Secular Growth and Transformation Stories driven by exceptional teams. Data guides decisions. We cater to high net worth investors, family offices, and institutional investors. Note: This information doesn't constitute a recommendation to buy or sell any mentioned securities. Avory is based in Miami, Florida with clients all across the globe.

Speak to us: Schedule a Brief Zoom Meeting

Send us an email: Team@avoryco.com

Want to invest? We are on most platforms.

Want More

🎥 Avory YouTube Channel

🎙️ Avory Podcast

Disclaimer: Not a recommendation to purchase or sell any securities mentioned. This is for educational purposes only.

Comments